“Tell me what is happening to the Hayes property market”, asked the friend of a friend at a recent do I went to in Hayes (after finding out I was an agent in Hayes).

I always reply, “It depends if you are buying, selling or both”.

The Hayes property market is like a seesaw. For the last two years, it has been quite firmly in the realms of a 90% seller’s/10% buyer’s market.

However, unless you are a Hayes buy-to-let landlord, Hayes first-time buyer, or executors selling a deceased person’s estate, most home movers are both (i.e. they are both sellers and buyers).

So, what determines where we are on the seesaw of a seller’s market or a buyer’s market?

It comes down to simple supply and demand economics. i.e. the number of properties on the market versus the number of buyers in the market.

Like when someone sells goods or services, it’s the same with property. So, when we have a low supply of properties on the market and high demand for properties to move into (like we have had for the last two years since the end of lockdown one), house prices go up.

Hayes house prices are 7.8% higher than a year ago.

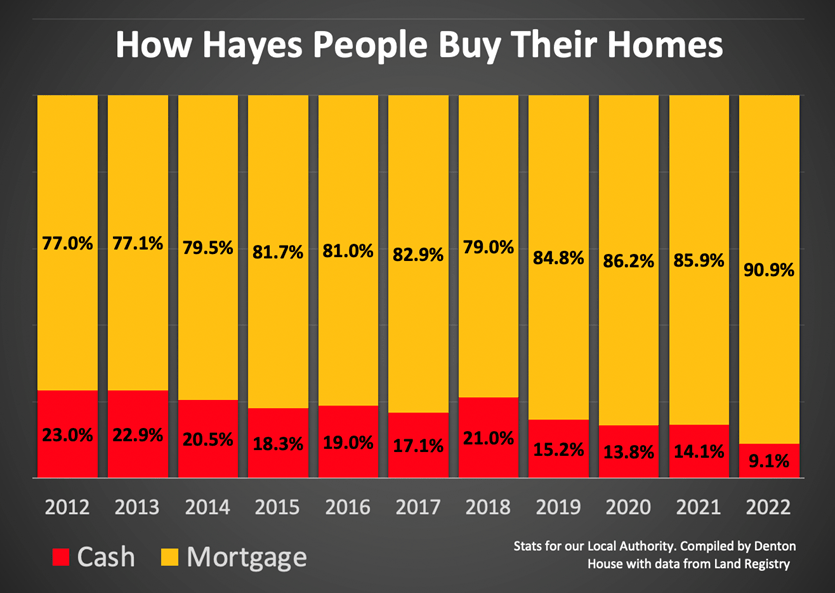

The other side of the coin was seen in the Credit Crunch years of 2008/9. Many people wanted to sell their houses in Hayes, yet the banks weren’t lending, so people couldn’t buy. This meant the supply of property on the market exceeded demand; hence Hayes house prices dropped by 16% to 19% in 18 months (depending on what type of property you were selling) as we had a 20% seller’s market / 80% buyer’s market.

Whilst demand and supply are the key driving force on the balance of the buyer/seller’s market seesaw, it is not the only influencer of the property market. The price band is also an essential determiner of house prices, albeit over the longer term.

To show this, initially, I will go back to 1995 to ascertain what has happened to average house prices over the long term in Hayes.

The average Hayes house price has risen from £81,424 in 1995 to £505,539 in 2021, a growth of 520.9%.

Interesting, when you compare that against the national figure of 407.2%. Also, looking at where our local authority stands against other areas, we are 42nd out of 331 local authorities in England & Wales for house price growth.

It’s called the property ladder for an excellent reason, and the health of the whole Hayes property market is very dependent on those bottom rungs of that ladder.

Therefore, looking at the data for our local authority, paying particular attention to the lower end (in terms of price), some intriguing data comes to light. It is crucial as the lower end of the property market (in terms of price) is a good bellwether for the whole Hayes property market.

So, I looked at the following …

- Lower 10th Percentile of the Hayes housing market – i.e., the bottom 10% in terms of the value of properties sold – e.g., small apartments and ex-local authority properties in the less popular areas, which mainly attract buy-to-let landlords.

- Lower Quartile of the Hayes housing market – i.e., the bottom 25% of Hayes property in terms of their value, e.g., first-time buyer homes and mid-market buy-to-let property.

… and if one looks at our figures for Hayes and the whole local authority, you can see the three parts (lowest 10% / lowest 25% and overall average) have performed quite differently.

- The average value of a Hayes property sold in 1995 in the lower 10th percentile (i.e., the bottom 10% of the Hayes property market) was £44,000, and in 2021, it was £275,000, a growth of 525% (compared to the national average of 428.4%).

- The average value of a Hayes property sold in 1995 in the lower quartile (i.e., the bottom 25% of the Hayes property market) was £56,500, and in 2021, it was £365,000, a growth of 546% (compared to the national average of 417.7%).

Some of you might be asking yourself, what do all these different figures mean to Hayes homeowners, first-time buyers and landlords?

As the overall average is slightly below the lower 10th percentile and lower quartile growth figures, the middle to upper market in Hayes has performed worse than the lower end in terms of house price growth since 1995.

The thought I am trying to get across to every Hayes homeowner/buy-to-let landlord is that there isn’t just ‘one’ Hayes property market.

There are markets within markets – almost like a fly’s eye. It is essential not to look at just the headlines but delve deeper when considering what is really happening and not to just look at the overall averages.

As we enter the height of the summer, the Hayes property market seesaw has started to change ever so slightly, changing from the 90% seller’s/10% buyer’s market we have had in the last two years to more of a 70% seller’s/30% buyer’s market.

With that in mind, if you can spot trends before anyone else is aware of them you could find yourself some potential Hayes property bargains.