Many mature readers of this Hayes property market blog will remember buying their first home as 20 or 30 somethings, probably in Hayes many years ago, yet read the newspapers now and feel it is all doom and gloom for todays’ first-time buyers.

So, I wanted to look at the facts, instead of newspaper headlines.

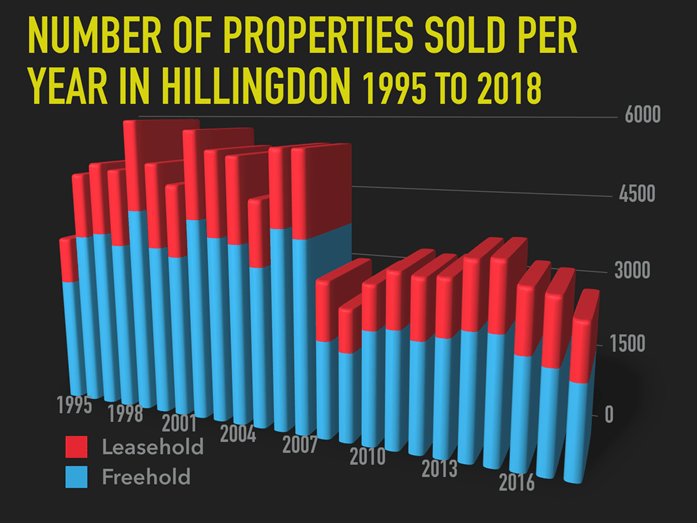

Back in 1995, the average Hayes first time buyers house cost £44,040, whilst official figures state today it is £248,400

So, looking at today’s property prices, it could be perceived that owning a home is beyond the reach of most Hayes first time buyers and that renting is the only way for younger members of Hayes society to have a roof over their head .. or is it?

100% mortgages (so no deposit needed to be saved) were rife in the 2000’s and Northern Rock were famous for their 125% mortgages (i.e. you borrowed 25% more than what you were paying for the house, again with no deposit). Yet when the credit crunch hit in 2008 such mortgages disappeared overnight – ending the dream of homeownership for many. Yet would it surprise you to hear that 95% mortgages (i.e. the first-time buyer would need to save a 5% deposit) have been available since late 2009 and 100% mortgages (i.e. no deposit) were made available in 2016.

It is £229 per month cheaper to buy a typical Hayes first-time buyer home than to rent the equivalent property.

Prospective Hayes first-time buyers could make a saving of £2,753 per year on average if they moved from renting to owning. My calculations assume that first-time buyers raise a deposit of just 5 per cent and make mortgage payments over 35 years with the Barclays 95% mortgage with a fixed interest rate of 2.48 per cent interest. At this level…

Today, the average deposit needed by a

Hayes first-time buyer is £12,420

Those able to raise that deposit, would pay £876 pm on average in mortgage payments, while the average rent for the same property would be £1,105 pm and the household income to support such a mortgage would need to be from £52,440 pa.

Of course, buying your first home is a massive financial commitment and investment with up-front costs to ponder on, yet long-term the financial benefits can be substantial. With annual savings of £2,753 a year, this can really mount up over time and, of course, once the mortgage is paid off, one will have a valuable asset.

Yet, the elephant in the room is the raising of the 5% deposit

Well most first time buyers, even most of you who are now in your 50’s and 60’s may have used the Bank of Mum and Dad to help with the deposit, yet it’s only fair that most parents still expect their offspring to contribute to the deposit and this is where it comes down to choice. I have spoken to many of my friends and family to reconfirm my initial thoughts that it comes down to priorities and choices in life. To save the deposit mentioned above, sacrifices are required to save that amount of money.

According to a survey in 2018, the average millennial goes out two nights a week and spends on average £63.36 per night out, that’s nearly £6,600 per year – a very expensive hobby. Nearly a third of millennials surveyed had smashed their mobile phone in the last 12 months. Then there is the obsession of having the latest tech, with the need to constantly be upgrading one’s mobile phone. In fact, the cost of the brand new iphone11, recently released, is just shy of £900. Even those on contracts can expect to pay upwards of £80 per month for the newest phone upgrade, yet if they kept their old phone after two years, a sim only deal with the same minutes and data would set them back no more than £25 per month … it comes down to choices. Save for a deposit and reduce your expenditure on socialising and mobiles etc and have a valuable asset at the end of your mortgage or continue as you are.

I am not here to make a judgement – everyone is free to make their own choices in life – all I am doing is highlighting the real situation – so you are aware of the full story.