One of my Hayes landlords contacted me last week from Yiewsley, after he had spoken to a landlord friend of his from Southall. He told me they were deliberating the Hayes property market and neither of them could make their mind up if it was time to either sell or buy property following Covid-19. His friend said he would wait to see what would happen to property prices following Covid-19, yet my landlord wanted to pick my brain in order to help him decide what to do.

I said the press are aware bad news sells newspapers and the doom mongers are plying their trade on uncertainty in the world economic situation. Roll the clock back to the Credit Crunch of 2008/9, and there were quite a few landlords in Hayes who had overexposed themselves with high percentage loan to value buy to let mortgages, backing the hope they would make their money on the capital growth, yet fell foul of a drop in rents and thus got bankrupted (but who could blame them when the property market was rising at 15% to 20% a year in the early 2000’s and banks like Northern Rock were giving mortgages out to anyone with a pulse and note from their Mum).

Thankfully the Bank of England changed the rules on all mortgages in 2014 banning self-certification mortgages, tightening the rules around interest-only mortgages and the requirement around affordability to be checked, plus a tough stress test if interest rates rose. It’s obvious we are going to enter into a recession because of Covid-19, yet this time the Hayes property market is better placed to weather the storm.

However, gone are the days when you could buy any old house in Hayes and it would make money. Yes, in the past, anything in Hayes that had four walls and a roof would make you money because since World War 2, property prices doubled every seven years … it was like having a free cash machine.

If a landlord bought a Hayes terraced / town house in the summer of 2000, he or she would have seen a profit of £209,300 to its current value of £333,100, a rise of 169.2%

Nonetheless, if that landlord had bought the same property in 2010, the Hayes landlord would have only made £78,800 profit (a 39.9% increase). Yet since 2010, the country has experienced 31.5% inflation, meaning our Hayes landlord has seen the ‘real’ value of their Hayes property increase by only 8.4% (i.e. 39.9% less 31.5% inflation).

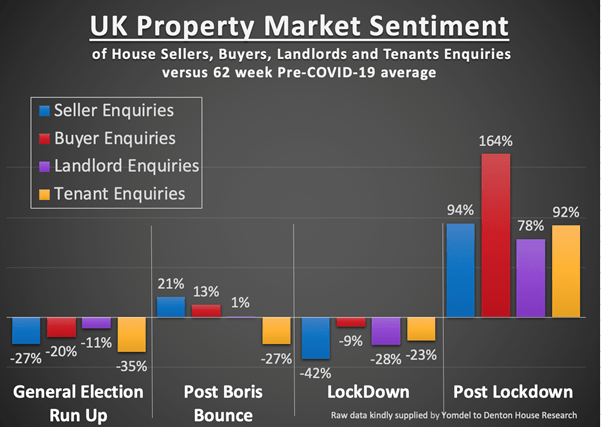

And this is my point. Nobody has been complaining about the property market in the last ten years, yet even after inflation, landlords are still making only the smallest of profits. If we do see a slight dip in property prices because of Covid-19 (looking at the market at the moment I haven’t seen any indication of its slowing down from its post lockdown takeoff), but if we do, Hayes landlords need to realise property values aren’t the only indicator of whether the property market is good or not.

The reality is, since around the early 2000’s we haven’t seen anything like the capital growth in property we have seen in the past and it’s not predicted to grow at the rates it has previously done either. So, I believe it is high time for any Hayes landlord, pondering investing in Hayes property to stop believing the hype and do some serious research using independent investment expertise. You can still make money by buying the right Hayes property at the right price and finding the right tenant.

Think about it, properties in real terms are only 8.4% higher than a decade ago, so investing in Hayes property is not only about capital growth, but also about the yield (the return from the rent). It’s also about having a balanced property portfolio that will match what you want from your investment – and what is a ‘balanced property portfolio’? Well we discuss such matters on the Hayes Property Blog … if you haven’t seen the articles, then it might be worth a few minutes of your time?