Over the last six months, the Hayes Property Market has been flourishing. As soon as an estate agents ‘For Sale’ flag went up, neighbours would be checking out Rightmove to see the internal pictures and compare the asking price to their own home (go on .. admit you do that too – every Hayes homeowner does). Flabbergasted by optimistic asking price tags, those same Hayes homeowners stand open-mouthed to see a sold slip added to the board a few weeks later.

Property values in Hayes are 6.6 per cent higher than a year ago.

The newspapers are full of stories of this mini property market boom, which has been fuelled by the Stamp Duty Tax cut, which ends on the 31st March 2021. Not only has it pushed up values in Hayes, but it has also theoretically brought forward house moves from 2021 into 2020.

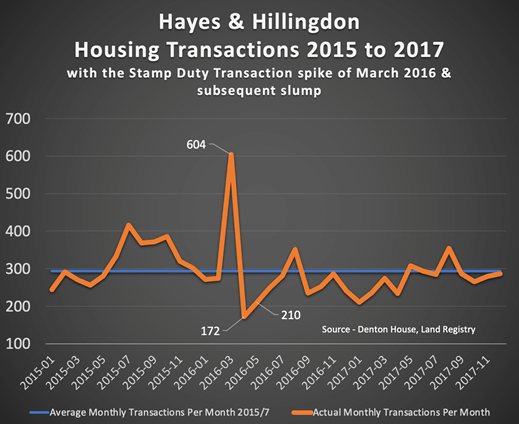

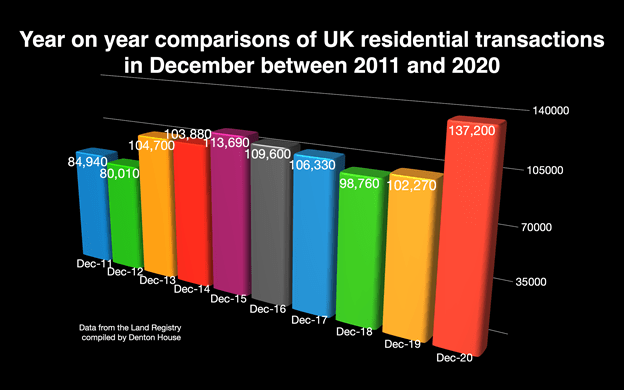

The most up-to-date transaction figures (i.e. the number of people moving home) endorse it too. In the UK, 137,200 property sales/transactions took place in December, the highest number of sales/transactions in December since 2006 (when it topped 149,200 transactions, only for it to fall to 32,700 transactions in December 2008 at the height of the Credit Crunch).

The exact figures from the Land Registry for Hayes won’t be available for another six weeks or so, yet in December 2019, 48 properties changed hands in Hayes. Looking at anecdotal evidence of for sale board changes, my database and the portals, I believe we will end up around 64 to 73 Hayes property sales/transactions for December 2020.

So, how does all this compare to other years?

The number of UK transactions continued to be relatively stable between November 2019 and March 2020. That decreased by around half in April/May 2020 compared to April/May 2019, triggered by economic impacts relating to the public health restrictions introduced. Since the first lockdown was lifted in the late spring, sales/transactions have increased steadily upwards each month, mirroring the relaxing public health restrictions for the property market during the summer and autumn of 2020 and introducing Stamp Duty Tax Holidays.

Before we all get the Champagne corks flowing, what the December national figures (and the corresponding provisional Hayes stats) don’t tell us, is that April to December 2020 transactions ended the year 13.7 per cent down compared to April to December 2019 transactions — the lowest since 2012. Don’t get me wrong, 13.7 per cent is impressive given that we are in the middle of a recession and even more remarkable considering there was a 48.7 per cent fall in transactions in 2008 (compared to 2007) when the Credit Crunch hit.

The biggest question though, is, how much of the urgency since the summer to buy property can be credited to the …

- existing pent-up demand that built up in 2018/9 and was starting to be released in the ‘Boris Bounce’ in January/February 2020

- new demand from home workers looking for bigger properties

- people moving out of the big city centres

- the Stamp Duty Tax cut

— or a mixture of all four?

Nobody can categorically know whether the UK property market would have ricocheted as quickly without the Stamp Duty Tax cut.

Talking to many buyers, sellers, agents and solicitors in the Hayes property market over the last three or four months, the anecdotal evidence I have collated from those people seems to imply that the outbreak of activity in the Hayes property market has mainly been put down to the lifestyle factors (bigger house with office space etc) and pent-up demand, meaning the Stamp Duty Tax Holiday is seen as the icing on the cake for most people. Yet, there will be some buyers, whose motivation has been purely to save money on the tax duty. Overall though, in the vast majority of house purchases, this allows us to be reasonably hopeful about what will happen once the Stamp Duty Tax Holiday is withdrawn on the 31st March.

However, some newspapers are preaching a story that the property market will collapse without a Stamp Duty Tax Holiday extension. Nobody can argue that a phased withdrawal from the Stamp Duty Tax Holiday would be better than some homebuyer’s sales falling through, when the tax holiday finishes in late March. Even if your motivation isn’t to save money on the tax holiday, it could be the motivation of a buyer in your chain – meaning it becomes your issue. Nobody knew in July, when the tax holiday was announced, that we would get another two national lockdowns with the inevitable delays from remote working by solicitors, mortgage providers and local authority search departments. My advice to all people currently sold subject to contract is to ask the question, “What if we don’t complete the sale by the end of March?”. Better to sort it now than have a nasty surprise in the last week of March.

All property taxation is long overdue for reform, from Stamp Duty to Council Tax. When Margaret Thatcher tried to change local Rates to Poll Tax in the late 1980’s, those who are old enough can remember the Poll Tax Riots, hence the nervousness of any party since to make any changes. There is no way the Government will abolish Stamp Duty when it raises between £11bn to £13bn a year, yet with all the upheaval we have experienced in the last year, there could be an appetite to change the way property is taxed.

The Government has already spent £271bn on interventions due to the pandemic and needs every penny so that it can start to repay those debts over the coming decades.

I have a feeling most Hayes property buyers and sellers would compromise on the price they pay for their next home to cover the cost of the Stamp Duty Tax after April, rather than lose the chance of owning the forever home they longed for during the first lockdown.

Therefore, don’t be alarmed when we see property values ease slightly in Q3 2021 when the price paid for property reflects the lower price to account for the Stamp Duty that will need to be paid from the 1st April.

If you are a Hayes homeowner or Hayes buy to let landlord and you would like a chat about where you and your Hayes property stands in the current Hayes property market, don’t hesitate to give me a call or drop me a line.