Would it surprise you that there are 23% fewer properties for sale today in Hayes than the post Credit Crunch years 13 years ago? Property values are much higher than a decade ago and the property market at the moment in Hayes is on fire. In all my years as an agent, I have never seen it like it is at the moment. Many people are saying it’s reminiscent of 1988 when dual-MIRAS relief was abolished by Nigel Lawson, as people are paying top dollar for property, because they are buying property like there is no tomorrow.

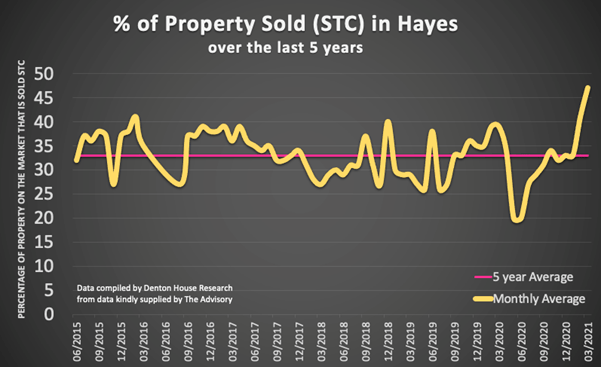

56.5% of properties on the market in Hayes are sold stc

In a ‘normal property market’, that figure would be between 30% to 40%. There is no rhyme or reason behind it because it’s not as if we are going to run out of property to sell (unlike the panic buying of loo rolls last year in the supermarkets). With such a buoyant Hayes property market, being adept to state what your Hayes property is worth is exceptionally problematic.

This is further exacerbated by the lower-than-average properties on the market at the moment. To give you an idea of the issue…

there are 325 properties for sale in Hayes today, compared to 421 in 2008.

When there aren’t many properties on the market, some estate agents, to gain your instruction, will value your Hayes property by giving you an over inflated suggestion for the asking price. Why do they do that when the considered wisdom is estate agents only get paid once they sell it?

Well would it surprise you that many (not all) estate agents pay their employees a bonus to put your property onto the market and then pay a further bonus when they get you to reduce the asking price? Some estate agents know the fastest way to get your property to market is to be optimistic on the asking price to secure your property for sale, then work on you to reduce your asking price after it has been sitting on the market for a few months.

Nothing wrong with that you might say, I want to get the most for my Hayes home (and it is indeed the job of the estate agent to get the best price for their client). If I believe it is worth testing the market at a slightly higher asking price, I will suggest that, yet will always explain my thinking and if we have over cooked the asking price, we can swiftly realign it after a couple of weeks.

Yet because many estate agents are disposed to suggest over inflated asking prices to the house seller just to secure their business (i.e. overvaluing) but not manage the property for month and months … this in turn causes Hayes properties to sit on the market and not sell.

In the best property market for 20 years, 22% of properties for sale in Hayes have been on the market for 6 months or more. Overvaluing is widespread among Hayes estate agents.

Most Hayes homeowners will ask three or four estate agents to value their Hayes home and take the middle figure when they want to sell. Yet, if all (or most) of your Hayes estate agents are over optimistic and they all give you a ‘gilded lily’ price to secure your instruction to sell your home (i.e. overvalue), then that middle figure will be too much. Most Hayes estate agents know they don’t win the business (i.e. secure the listing) if they tell the homeowner what they don’t want to hear.

So, what is the risk of overvaluing?

There is a potential massive cost to putting your Hayes home on the market at too high an asking price. Your estate agent will tell you that your Hayes home is worth a certain figure and then lock you in to a 16-week sole agency agreement (sometimes longer) which you cannot get out of early. If you are getting around two or three viewings a week, and the pictures and marketing material are half decent, then your pricing is about right, meaning in this market you should be sold (subject to contract) within a month to six weeks.

Yet, if your Hayes home has an over optimistic asking price (i.e. it is overpriced), you might only have a handful of viewings in a month and no offers. As the weeks and months go by, your overpriced Hayes home makes similar homes to yours (i.e. your competition) look really good value for money. That’s when you will get the price reduction call from the agent.

How many times have you seen a property that has been on the market a while and you have wondered what’s wrong with it? Also, to add insult to injury, the portals tell you how long a property has been on the market, adding weight to that argument.

The longer your property stays on the market, the desirability of your Hayes home drops.

You will end up selling your Hayes home but only after a handful of price reductions, yet at what cost? Firstly, in those lost months, you would have missed out on many properties that you fell in love with yet couldn’t buy because your home was languishing on the market with no interest (this is backed up by consumer champion Which, who said that if you have to reduce your asking price by 5% or more, it adds an extra 64 days to the sales process).

Secondly, you will end up selling your Hayes property for less than if you had placed the property on the market at a realistic asking price from day one (again backed up by Which). This is because buyers think there is something wrong with it, so as the homeowner gets fed up, they accept a lower offer to get their property sold.

Finally, because you take less for your property, your choice of the next property to buy will also be curtailed, meaning your dream home move might be more of a nightmare?

The best advice I can give you is to search the portals, make sure you look at properties that are also sold stc (which can normally be found by clicking on the filter section of the search on the portal). Then ask a couple of straight-talking trusted friends to do the same and compare your property to the competition that is both on the market and sold (stc).

Compare their locations, number and size of the rooms and size of plot and ask them where they see your property against those. Carry out the same exercise yourself (of course you will be slightly biased) and take a bellwether from all those figures. Then ask a number of Hayes agents to value your property and if you feel any are being overly optimistic challenge how they get to their figure and get them to qualify their belief in that figure – is their valuation realistically achievable in the market at the time? As we all know markets change and property prices go up and down and ultimately a property is only worth what a buyer will pay for it – this all requires careful consideration.

I can assure you most of the estate agents in Hayes are decent people, who want to do the best for you. All I ask is you do your homework and look at the sale of your Hayes property through the eyes of a cold-blooded buyer.

If you would like to chat about selling your Hayes home do give me a call.